I Need Car Insurance But Can't Afford It - Places That Help with Auto Insurance

I Need Car Insurance But Can't Afford It

You will get the information about I Need Car Insurance But Can't Afford It, For most US Citizens, going carless is unthinkable. You need one to buy food supplies, take children to class, visit a doctor's office and see loved ones every now and then. Except if you have a generally excellent companion ready to fill in as your chauffeur, living without a car doesn't work.

A handful of cities challenge the standard – New York, Washington, Chicago, Boston – because they have open transit that is plentiful and convenient. Ditching a car in those cities makes sense.

However, for every other person, not having a car is a special sort of damnation. Indeed, even people who scrape sufficiently together to buy one are grounded on the off chance that they can't afford the insurance bill.

What Happens If You Don't Pay Your Car Insurance

In case you're thinking about driving without insurance, don't. You'll lose your permit and face penalties in case you're pulled over, and the results of an accident while driving illegally could be devastating.

Nothing great originates from cruising the streets in an uninsured vehicle. About 6 million car accidents happen each year in the U.S, costing the country a total of $230.6 billion a year, or $820 a person.

The main reason individuals ditch their car insurance is to try and save cash, but the results of driving uninsured will cost you more over the long haul.

There are, however, options for individuals who can't afford their car insurance. Insurance suppliers offer a huge number of discounts ranging from safe drivers to low mileage deductions. Offers will vary, which is the reason it is important not to settle for the first supplier you go over. Learn more about I need car insurance but can't afford it.

One thing that's certain is that driving without auto insurance is illegal in each state (short New Hampshire). There's a reason for that: People are frequently harmed in car crashes, sometimes genuinely, and insurance is necessary to pay the bills and safeguard assets.

Most states require basic liability insurance to operate a vehicle. Many also call for uninsured motorists' coverage to compensate for wounds when one of the drivers in a crash lacks insurance. Some demand personal damage protection, a form of no-fault accident insurance that covers medical costs and even time off work.

Best Places That Help with Comparing Auto Insurance Quotes

Places That Help With Car Insurance

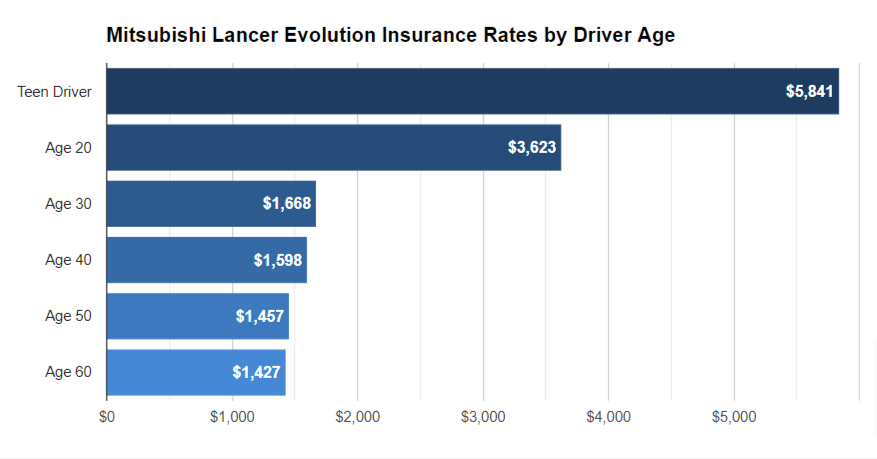

Auto insurance also can cover theft and non-collision damage, contingent upon a policy's terms. Rates vary according to other factors including a driver's age, driving history, how the guaranteed vehicle is utilized and where the driver lives.

When you have an insurance policy, it is important not to let it lapse. Always pay the premiums on time. You might consider keeping separate savings account for vital costs that incorporate insurance. Just utilize the account to pay essential bills, and keep it supported.

How to Afford Car Insurance for New and Young Drivers

You May Also Like Given Posts

Car Insurance for First Time Drivers Under 21

Comments

Post a Comment