2012 Camaro Insurance Cost for 16, 17, 18, 19, 20, 21 Year Old

2012 Camaro Insurance Cost

2012 Camaro Car Insurance Cost

Normal insurance rates for a 2012 Chevrolet Camaro Insurance Cost are $1,266 every year for full coverage. Extensive insurance costs around $248 per year, impact insurance costs $400, and liability costs $460. Purchasing a liability-just policy costs as meager as $510 every year, and high-hazard 2012 Camaro insurance costs $2,736 or more. Adolescent drivers get the most elevated rates at up to $4,866 every year.

Value Range by Coverage and Risk

For the normal driver, costs go from as low as $510 for a discount liability-just rate to a high of $2,736 for a driver that may require high-hazard insurance

How Much Is 2012 Chevrolet Camaro Insurance Cost

Attempting to discover less expensive insurance coverage rates? Purchasers have numerous alternatives while looking at the best cost on Chevy Camaro insurance Cost. You can either invest your energy calling around attempting to get quotes or use the web to get rate quotes. There are both acceptable and terrible approaches to search for insurance coverage so we will you the correct method to cite coverages for a Chevy and acquire the most reduced conceivable cost either on the web or from nearby insurance operators.

Chevy Camaro insurance rates comprise of numerous parts

A significant piece of purchasing insurance is that you know a portion of the components that have an impact in ascertaining auto insurance rates. Comprehending what decides base rates empowers educated decisions that may remunerate you with much lower yearly insurance costs.

Appeared underneath are a halfway rundown of the pieces auto insurance companies consider when setting rates.

How much is insurance on a 2012 Chevrolet Camaro

Liability coverage is significant serenity – Your policy's liability coverage will secure you if a court rules you are to blame for harms from a mishap. Liability gives legitimate protection coverage which can cost a large number of dollars. Liability is modest when contrasted with coverage for physical harm, so don't hold back.

Do you meet all requirements for a multi-policy discount? – Some safety net providers offer discounts to policyholders who unite strategies with them, for example, consolidating an auto and property holders policy. This can add up to five, ten or even 20%. Indeed, even with this discount, it's to your greatest advantage to examination shop to affirm you are getting the most ideal rates.

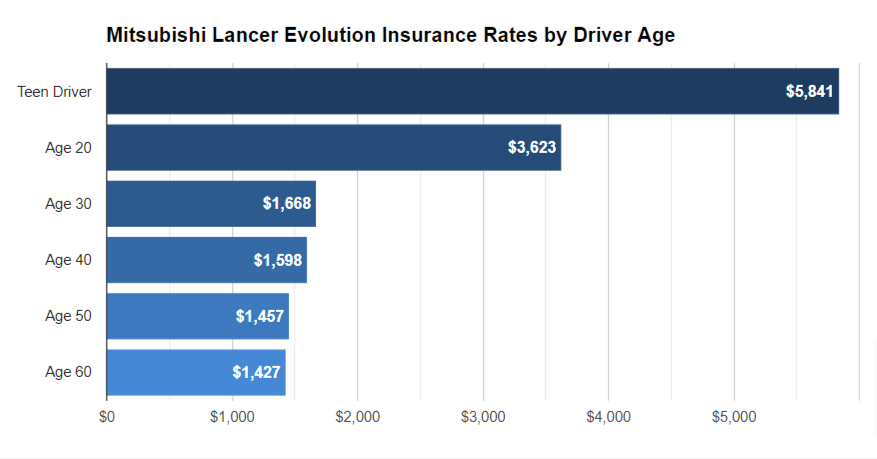

With age comes lower rates – Teen drivers tend to be careless and quickly drawn offtrack in the driver's seat so they pay higher auto insurance rates. Guardians including an energetic driver onto your auto insurance can burn up all available resources. More established drivers are more wary drivers, will in general record less cases and get less tickets.

Men are more forceful – Statistics show ladies are more careful in the driver's seat. Be that as it may, this doesn't mean ladies are BETTER drivers than men. Both genders cause mishaps at about a similar rate, however men have costlier mishaps. Men likewise get all the more costly references, for example, crazy driving. Adolescent male drivers are the most costly to guarantee and hence are the most costly to protect.

Pay less after the wedding – Having a mate really sets aside cash when purchasing auto insurance. Having a mate is seen as being more full grown it has been factually indicated that drivers who are hitched are more wary.

Legitimate use rating influences rates – The higher the mileage driven each year the more you'll pay to protect your vehicle. Most insurance companies value every vehicle's coverage dependent on how you utilize the vehicle. Autos left stopped in the carport can get a lower rate than those utilized for driving. Ensure your auto insurance revelations sheet is appraised on the right use for every vehicle, since it can set aside cash. Off base utilization on your Camaro might be squandering your cash.

Petty criminal offenses increment rates – Your driving record has a great deal to do with the amount you pay for insurance. Indeed, even a solitary speeding ticket may expand your cost by a fifth. Drivers with clean records have lower expenses contrasted with drivers with tickets. Drivers who get outrageous infringement, for example, quick in and out, DWI or careless driving feelings might be needed to present a SR-22 structure with their state DMV so as to keep their permit.

Permitting your policy to slip by raises rates – Allowing your auto insurance policy to pass will be a quick method to pay more for auto insurance. Not exclusively will you pay more, inability to give confirmation of insurance can bring about a disavowed permit or a major fine.

Related Posts

Comments

Post a Comment