How Much Does It Cost to Add a Driver to Car Insurance Policy - Cost to Add New Driver to Auto Insurance

In this post you will get all information about How Much Does It Cost to Add a Driver to Car Insurance Policy. You'll need to add someone to your car insurance policy if they live with you and have regular access to your car: otherwise, you risk being denied coverage if they get in a crash. Adding someone to your car insurance does impact your rates, but it won't always have a negative effect—sometimes, you'll actually save money, depending on the age and driving history of everyone you add to your policy.

Adding a new driver to your existing car insurance policy is usually a quick and easy process. Much like adding a new vehicle to your existing policy, adding someone to your car insurance policy as a named driver involves contacting your auto insurance company and giving them some basic information about you, your vehicle and the new driver you want to add to your policy.

But before you add a new driver to your insurance policy, it’s important to consider who needs to be listed on your policy and how much adding a new driver will affect the cost of your monthly premiums. Know More About How Much Does It Cost to Add a Driver to Car Insurance Policy.

How Much Does It Cost to Add a Driver to Car Insurance Policy

Adding a driver to your car insurance policy will have an impact on your rates. However, it isn't the case that adding another driver will always raise them—in fact, we found that depending on who the primary and secondary drivers are, adding another driver can actually bring your car insurance costs down by a significant amount.

To understand the financial impact of adding a driver to an insurance policy, we gathered statements for three independent drivers—a 18-year-elderly person, a 30-year-elderly person and a 50-year-elderly person—and added two different secondary drivers to perceive how they would impact rates.

We found that in almost every case, adding an additional driver brought down the rates our sample driver would pay. Young drivers can hope to save the most: Adding another driver to his policy diminished our 18 year old's rates by more than $500. The main driver who actually paid more when adding an additional driver is a 50-year-elderly person who added a 30-year-elderly person to her coverage. Compare Free Auto Insurance Quotes.

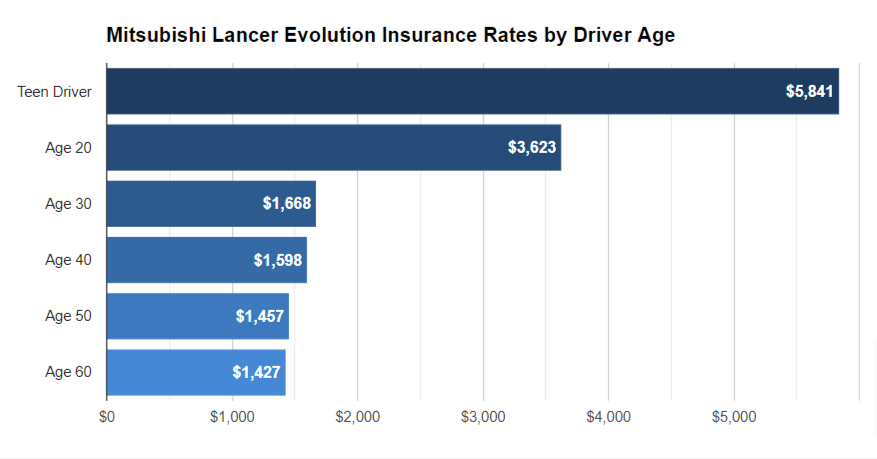

This is because insurers set rates based on the overall likelihood that a vehicle will be involved in a crash, and in this way, make an insurance claim. Teens are by a wide margin the well on the way to get into automobile accidents and have the highest rates, so a car shared by a 30-year-old and a 18-year-old is less likely to be involved in a crash than one driven exclusively by a teen.

Does it cost to add a driver to my policy

Adding an experienced driver with a clean record to your car insurance policy typically will not cost you more money. However, if you add a driver to your policy who has recent accidents or traffic violations, the insurance company may charge you more. How much more will depend on how risky the insurance company considers the additional driver to be.Compare Car Insurance with Bad Driving Record.

If you're a young driver and you add your parents, who have a clean driving record, to your policy, you will typically pay less than you would if you left them off your coverage. If you are a parent and you add your young driver to your policy, it will likely cost more to insure him or her on your policy. Teens and young drivers, typically under age 26, are considered high-risk drivers by insurance companies, so they pay higher rates than other age groups.

What about adding a teen driver to my insurance policy?

One instance in which adding a driver to your policy will likely raise your rates is when you’re adding a teen driver or a newly licensed young driver to your coverage. Car insurance companies see teens and young drivers as high-risk because of their age and inexperience, meaning they can be very expensive to insure. When you’re adding a teen to your coverage, make sure to look into discounts specifically for teenage drivers, like good student discounts or discounts for taking extra driver’s education courses. Some insurance companies even offer special programs for teen drivers that track their driving and provide feedback. Know more about How Much Is Car Insurance Per Month for a 16 Year Old Boy.

Who Should be On My Auto Insurance Policy?

The main person insuring the car will be the one deciding all secondary drivers. The primary insured is usually the car’s owner or main driver.

As the main policyholder, you can add secondary drivers if they:

- Are a family member

- Live at the same home address

- Use the car regularly

Drivers you may need to add include:

- Spouse

- Roommates

- Teenage drivers

- Family members living with you

Contact your insurance company if you have a question or special situation. Some insurers may require you to add friends or family members who use your car but don’t live at your address.

What will insurers need to know about the additional driver?

When adding a driver, your car insurance company will typically want to know the following about the person you are adding to your policy:

- Name

- Age

- Marital status

- Address

- Occupation

- Accident and moving violation history

How to add a driver to your car insurance in 5 steps

Adding or removing drivers from your policy is easy with a simple phone call to your insurance company. In many cases, you can also log in to your online account to update this information.

- Call your insurance company or log in to your online account

- Request to add or remove secondary drivers to your account

- Provide the necessary information about the driver, including reason for being added or removed

- Ask any questions about insurance rates and available discounts

- Request written confirmation as proof for your records or save the updated driver information online

What about adding a teen driver to my auto insurance policy?

One instance in which adding a driver to your policy will likely raise your rates is when you’re adding a teen driver or a newly licensed young driver to your coverage. Car insurance companies see teens and young drivers as high-risk because of their age and inexperience, meaning they can be very expensive to insure. When you’re adding a teen to your coverage, make sure to look into discounts specifically for teenage drivers, like good student discounts or discounts for taking extra driver’s education courses. Some Car insurance companies even offer special programs for teen drivers that track their driving and provide feedback.

We found that in almost every case, adding an additional driver lowered the rates our sample driver would pay. Young drivers can expect to save the most: Adding another driver to his policy reduced our 18-year-old's rates by more than $500. The only driver who actually paid more when adding an additional driver is a 50-year-old woman who added a 30-year-old man to her coverage.

This is because insurers set rates based on the overall likelihood that a vehicle will be involved in a crash, and thus, make an insurance claim. Teens are by far the most likely to get into automobile accidents and have the highest rates, so a car shared by a 30-year-old and an 18 year old car insurance cost is less likely to be involved in a crash than one driven exclusively by a teen.

CAN I ADD MY ROOMMATE TO MY AUTO INSURANCE POLICY?

You may be able to add your roommate to your car insurance since you live at the same address. If you own a car but your roommate does not, the insurance policy for the car needs to be in your name. Ask your agent about adding your roommate to your car insurance policy as an operator (driver) of your vehicle.

In situations where each person living at the same address has their own vehicle, you'll each need to have your own auto insurance policy. If you are likely to drive each other's cars, check with your agent to be sure your coverage extends to other drivers and to learn whether you should include them as operators on your policy. Compare cheapest car insurance with no down payment.

CAN I ADD A DRIVER TO MY AUTO INSURANCE IF THEY LIVE AT A SEPARATE ADDRESS?

Generally, people listed on an auto insurance policy must be the owners of the vehicle or related to the owner.

If you have a child who is using the family vehicle while away at college, you may be able to keep them on your car insurance policy.

You typically will not be able to add a non-related driver who does not live in your home to your insurance policy.

If you and a friend own a vehicle together but do not live at the same address, you may have trouble obtaining an auto insurance policy. Your insurance agent can help you determine the best way to handle this situation.

CAN I ADD MY ROOMMATE TO MY CAR INSURANCE POLICY?

You may be able to add your roommate to your car insurance since you live at the same address. If you own a car but your roommate does not, the insurance policy for the car needs to be in your name. Ask your agent about adding your roommate to your car insurance policy as an operator (driver) of your vehicle.

In situations where each person living at the same address has their own vehicle, you'll each need to have your own instant auto insurance policy. If you are likely to drive each other's cars, check with your agent to be sure your coverage extends to other drivers and to learn whether you should include them as operators on your policy.

Temporary Adding Someone to Your Car Insurance Policy

If someone—whether they're a guest staying with you, a babysitter or anyone else—will be frequently using a car you own over an extended period of time, we recommend adding them to your auto insurance policy temporarily. But the threshold for when it's actually necessary to do so will depend on their exact relationship with you, how long they'll be using your car and your specific insurance company's policies. For example, if you've hired a babysitter for a one-time job and loan them your car, you probably wouldn't have to add them; but if you employ your babysitter on an ongoing basis and they regularly borrow your car, you likely would. Contact your insurer to find out whether you should temporarily add someone to your insurance policy. Compare cheapest car insurance with no deposit.

What are drivers on my car policy covered for?

Car insurance typically follows the car, not the driver. Generally, your policy will maintain the same coverage, no matter which named driver is behind the wheel.

Your liability coverage will still cover medical bills and vehicle damage to the other person involved in an accident, even if the secondary driver was at fault. Your collision coverage would cover your own car’s damages, and you’d file a claim with your insurance as normal.

However, check how your insurance handles coverage for secondary drivers, especially with add-ons like medical payments. Some policies will consider your insurance as the primary coverage until you reach your limits, then use your secondary driver’s insurance to cover expenses past your maximum coverage.

Other Articles You May Interested In

Other Articles You May Interested In

- Texas Car Insurance Minimum

- 2019 Acura MDX Insurance Cost

- How to Get Cheap Car Insurance for New Drivers Under 21 Male

- Why is Car Insurance So Expensive for Young Male Drivers

- Honda Civic Car Insurance Cost

- Car Insurance Cost for Married Couple

Comments

Post a Comment