What is SR22 Insurance Cost - What Does SR22 Insurance Cost

What is SR22 Insurance Cost

What is a SR22 insurance form?

In this article I will give you a all information on what is sr22 insurance cost and how to get it.

A SR22 affirmation is a form that is recorded with the state, not a kind of insurance.

A SR22 declaration of money related duty checks that the named individual is carrying in any event the state-commanded measure of car insurance. The insurance organization is ensuring to the express that you're keeping up coverage and are monetarily liable for any mishaps, and it will inform the state as to whether you don't.

Where do you get SR22 insurance?

The best way to acquire a SR22 form is from a car insurance organization after you buy a car insurance strategy. You can't get a SR-22 some other way.

In the event that you have an existing auto strategy, you might have the option to have the SR22 included and recorded with the state. In the event that your insurance organization doesn't document the form, or you're uninsured, you'll need to search for another strategy. Figure out how to purchase SR-22 insurance first so there are no surprises.

For what reason is a SR22 insurance form required?

Many partner the requirement for a SR22 with drivers who have a DUI on their record. If so for you, found out about DUI insurance. In all actuality, the SR22 can be required for an assortment of reasons, contingent upon where you live.

Basic conditions that bring about a SR22 insurance requirement incorporate the accompanying:

- DUI or DWI or other significant liquor violation conviction

- Genuine moving violation conviction, for example, foolish or careless driving

- A few traffic offenses in a brief timeframe period

- Driving without insurance conviction

- Being associated with a mishap while driving without insurance

- Being gotten by the state not carrying car insurance on your registered vehicle

- A requirement for you to acquire a difficulty or trial permit

- A requirement to restore your driver's permit after a suspension or disavowal

Meeting the SR22 requirement can assist you with getting your permit and additionally registration reestablished and consequently get you back out and about. You'll realize it's necessary when you're informed by the court or state. The notice ought to inform you why a SR22 is required, the insurance requirements and how long the SR-22 form must remain on document with the state.

How much does SR22 insurance cost?

Car insurance companies can charge a one-time recording expense, for the most part it is $25, and that is all the SR22 form will cost you.

However, the violation that brought about a SR22 requirement will influence your auto insurance expense. To put it plainly, it's your infraction - not the SR22 - that will climb up your rates. Your rate will hop by a normal of 89% for a SR22 documenting with one DUI, or about $1,300 more, a year, as indicated by a rate analysis by Insurance.com.

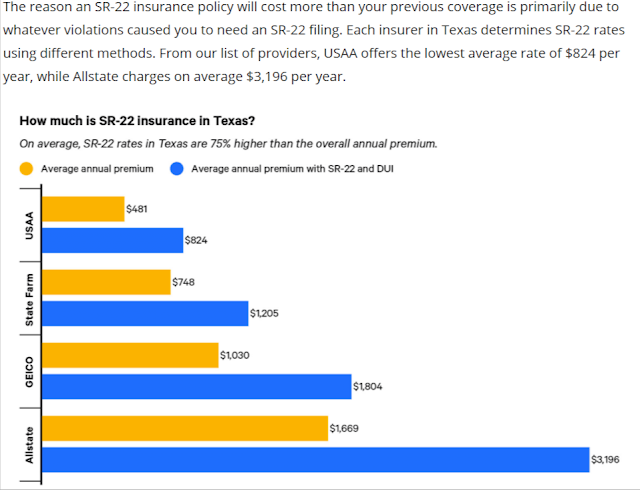

How much does sr22 insurance cost a month in Texas

How much does sr22 insurance cost in Illinois

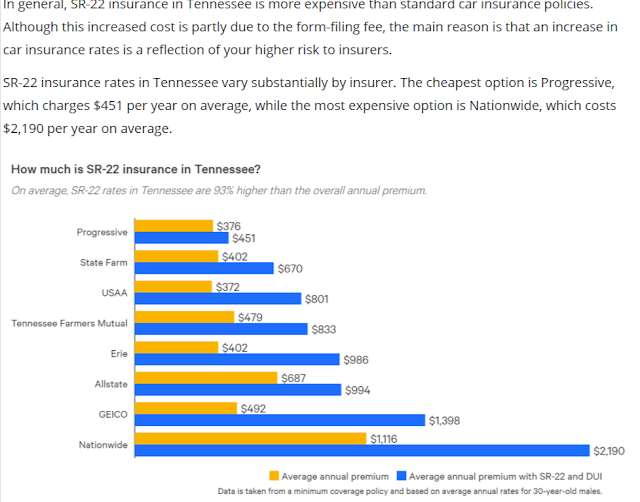

How Much Does SR22 Insurance Cost in Tennessee

Also Compare How Much Does SR22 Insurance Cost in Below States:

- Indiana

- Missouri

- Ohio

- Washington State

- Florida

- Arizona

- Alabama

Related Posts:

Comments

Post a Comment